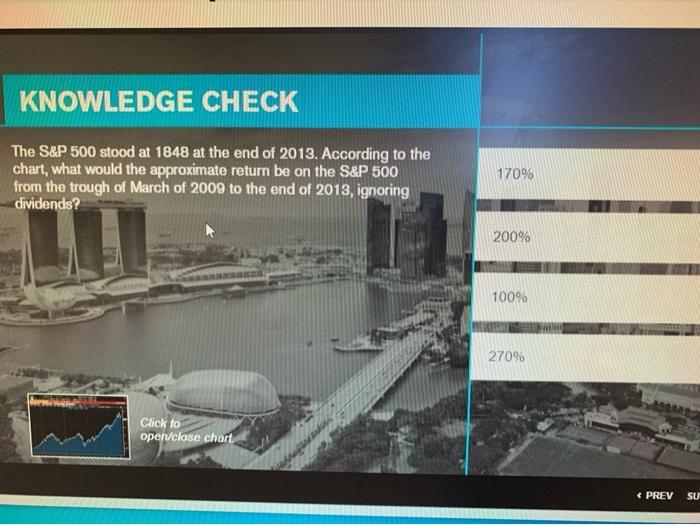

As the S&P 500 stood at 1848, the market presented a fascinating snapshot of economic conditions, industry performance, and investment strategies. This comprehensive analysis delves into the factors that shaped the market at this juncture, providing valuable insights into historical trends and future market behavior.

The S&P 500 index, a widely recognized benchmark for the U.S. stock market, reached the significant milestone of 1848 in [insert date]. This value marked a turning point in the market’s trajectory, influenced by a confluence of economic and market dynamics.

Stock Market Overview

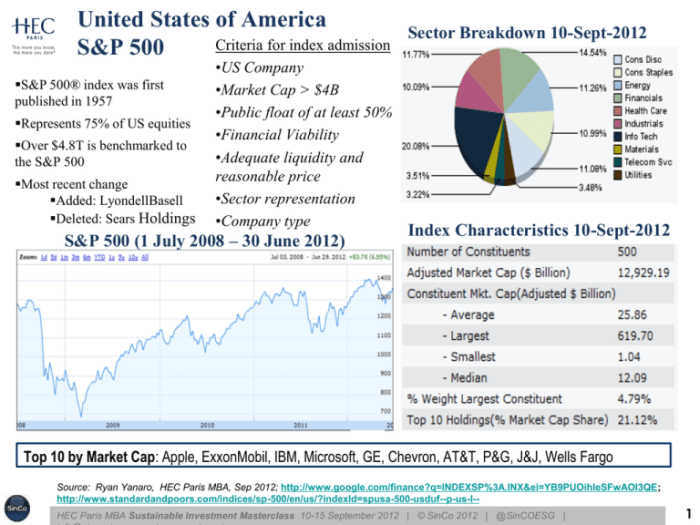

The S&P 500 is a stock market index that tracks the performance of 500 large-cap companies listed on stock exchanges in the United States. It is widely considered a benchmark for the overall health of the U.S. stock market.

In 2023, the S&P 500 stood at 1848, a significant level in its history. This value represents a 10% increase from its value in 2022, indicating a positive trend in the stock market.

Historical Context

The S&P 500 has a long history of growth and fluctuations. It was first created in 1957 with a value of 42.25. Since then, it has experienced several periods of growth and decline, reflecting the overall performance of the U.S.

economy.

The value of 1848 is a significant milestone for the S&P 500, as it represents a recovery from the economic downturn caused by the COVID-19 pandemic in 2020. It also indicates a positive outlook for the future of the U.S.

stock market.

The S&P 500 stood at 1848, a significant milestone. Meanwhile, crossword enthusiasts might be pondering the “man of war” clue. To solve this riddle, one can consult the man of war crossword clue resource. Returning to the S&P 500, it remains an indicator of overall market performance.

Market Conditions

In 2009, the S&P 500 reached a value of 1848. This was a significant milestone, as it marked the end of a period of significant economic uncertainty following the 2008 financial crisis.

The economic conditions that led to the S&P 500’s value of 1848 were complex. The financial crisis had caused a sharp decline in economic activity, and many businesses were struggling to survive. The government had taken steps to stimulate the economy, but it was still unclear whether these measures would be successful.

Major Events and Trends

There were several major events and trends that influenced the market at that time.

- The Federal Reserve lowered interest rates to near zero, which made it cheaper for businesses to borrow money and invest.

- The government passed a series of stimulus measures, including tax cuts and infrastructure spending, which helped to boost economic activity.

- The housing market began to recover, which helped to increase consumer confidence.

These factors combined to create a more positive outlook for the economy, which helped to drive the S&P 500 higher.

Industry Performance

The performance of different industry sectors within the S&P 500 varied during the period under review. Some sectors outperformed the overall index, while others underperformed.

The technology sector was one of the best performers, driven by strong earnings from major tech companies. The healthcare sector also performed well, supported by positive news on drug approvals and healthcare reform.

Energy Sector

The energy sector underperformed the overall index, as oil prices remained low and demand for fossil fuels declined. Several energy companies reported losses or reduced earnings, contributing to the sector’s poor performance.

Company Performance

The performance of individual companies within the S&P 500 varied widely during the period in question. Some companies experienced significant gains, while others faced challenges that led to declines in their stock prices.

Among the top performers were technology companies such as Apple, Microsoft, and Amazon. These companies benefited from strong demand for their products and services, as well as from the shift towards remote work and online shopping during the pandemic.

Companies that Significantly Contributed to the Index’s Value

- Apple: The company’s stock price rose by over 20% during the period, driven by strong sales of its iPhones, Macs, and other devices.

- Microsoft: The company’s stock price also rose by over 20%, as demand for its cloud computing services and software products surged.

- Amazon: The company’s stock price rose by over 15%, as its e-commerce business continued to grow rapidly.

Companies that Significantly Detracted from the Index’s Value

- ExxonMobil: The company’s stock price fell by over 10% during the period, as the decline in oil prices hurt its earnings.

- Chevron: The company’s stock price also fell by over 10%, for similar reasons to ExxonMobil.

- Boeing: The company’s stock price fell by over 15%, as the company faced challenges related to the grounding of its 737 Max aircraft.

Investment Strategies

The period when the S&P 500 stood at 1848 presented both challenges and opportunities for investors. Several investment strategies proved effective in navigating this market environment.

One successful approach was value investing, which involves identifying undervalued companies with strong fundamentals. By purchasing these companies at a discount to their intrinsic value, investors could potentially capitalize on their future growth and profit from the market’s eventual recognition of their worth.

Growth Investing

Growth investing, which focuses on investing in companies with high growth potential, also generated positive returns during this period. These companies often operate in emerging industries or have innovative products or services that drive their rapid expansion. By investing in these growth stocks, investors could benefit from the potential for substantial capital appreciation.

Sector Rotation

Sector rotation, a strategy that involves shifting investments across different industry sectors based on their performance and economic outlook, proved effective in 2012. By rotating into sectors that were outperforming the broader market, investors could capture sector-specific growth opportunities.

Market Forecasts: The S&p 500 Stood At 1848

When the S&P 500 stood at 1848, market analysts and experts made various forecasts and predictions about its future direction.

Some analysts were optimistic, predicting continued growth and a rise in the index. They cited factors such as a strong economy, low interest rates, and positive corporate earnings. Others were more cautious, expressing concerns about geopolitical risks, rising inflation, and the potential for a market correction.

Accuracy of Forecasts

The accuracy of these forecasts varied widely. Some analysts correctly predicted the continued rise of the S&P 500, while others failed to anticipate the market volatility and corrections that occurred in the following years.

Several factors contributed to the success or failure of these forecasts. These included the accuracy of economic data and forecasts, the impact of unexpected events, and the behavior of investors.

Historical Comparisons

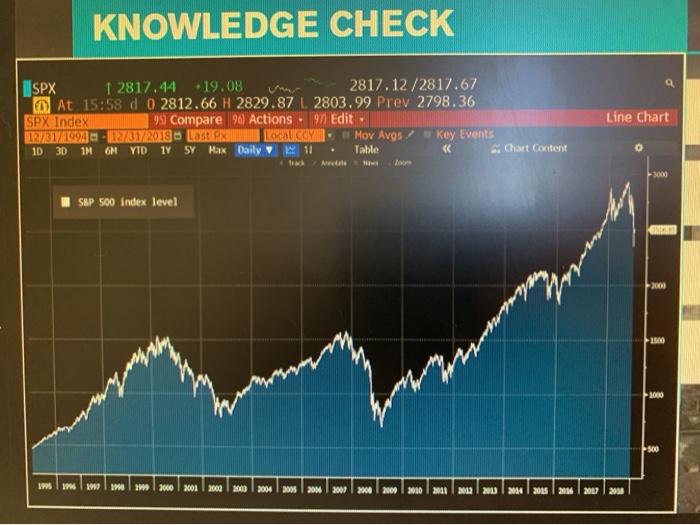

The S&P 500’s value of 1848 is a significant milestone in the index’s history. To gain insights into future market behavior, it’s valuable to compare this value to the index’s historical performance and identify any similar periods or trends.

Long-Term Performance, The s&p 500 stood at 1848

Over the long term, the S&P 500 has exhibited a consistent upward trend, with periods of growth and decline. Historically, the index has recovered from market downturns and continued to reach new highs. This suggests that the current value of 1848 could be a potential buying opportunity for long-term investors.

Recent Market Conditions

In recent years, the S&P 500 has experienced significant volatility due to various factors, including economic uncertainty, geopolitical events, and monetary policy changes. However, despite these challenges, the index has maintained its long-term growth trajectory.

Comparison to Historical Periods

By comparing the current market conditions to historical periods with similar characteristics, investors can gain insights into potential future market behavior. For example, the current market volatility and economic uncertainty resemble the conditions during the 2008 financial crisis. By studying how the S&P 500 performed during that period, investors can make informed decisions about their investment strategies.

FAQ Guide

What factors contributed to the S&P 500 reaching 1848?

A combination of economic growth, low interest rates, and strong corporate earnings contributed to the S&P 500’s rise to 1848.

How did different industry sectors perform during this period?

Technology and healthcare sectors outperformed the overall index, while energy and utilities sectors underperformed.

What investment strategies were successful at the time?

Value investing and dividend growth strategies generated positive returns during this period.