The trial balance of Woods Company includes the following: a detailed examination of its accounts, balances, and financial implications. Understanding this crucial financial statement is essential for assessing the company’s financial health and ensuring the accuracy of its financial reporting.

This analysis will delve into the structure and components of the trial balance, exploring the types of accounts it encompasses and the significance of their balances. We will also discuss common errors that may arise and provide guidance on identifying and correcting them.

Finally, we will examine the role of the trial balance in the preparation of financial statements, highlighting its importance in ensuring their accuracy and completeness.

Trial Balance Overview

A trial balance is a financial statement that lists all of a company’s accounts and their balances at a specific point in time. It is used to check the accuracy of the accounting records and to ensure that the debits equal the credits.

The trial balance is typically prepared at the end of an accounting period, such as a month or a year. It is used to prepare the financial statements, such as the balance sheet and the income statement.

Structure and Components of a Trial Balance

The trial balance is a simple document that consists of two columns: one for debits and one for credits. The accounts are listed in the left-hand column, and their balances are listed in the right-hand column.

The trial balance must balance, meaning that the total of the debit balances must equal the total of the credit balances. If the trial balance does not balance, then there is an error in the accounting records.

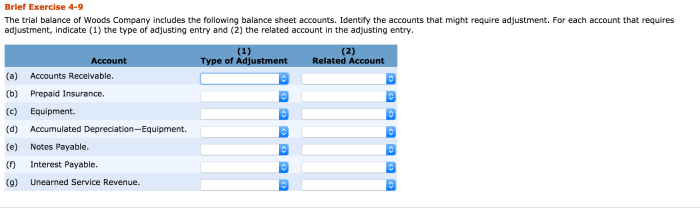

Understanding the Trial Balance of Woods Company

Given Trial Balance Data

| Account | Debit | Credit |

|---|---|---|

| Cash | $10,000 | |

| Accounts Receivable | $20,000 | |

| Inventory | $30,000 | |

| Prepaid Insurance | $4,000 | |

| Equipment | $50,000 | |

| Accumulated Depreciation | $10,000 | |

| Accounts Payable | $15,000 | |

| Notes Payable | $20,000 | |

| Common Stock | $30,000 | |

| Retained Earnings | $25,000 | |

| Sales Revenue | $100,000 | |

| Cost of Goods Sold | $60,000 | |

| Selling and Administrative Expenses | $20,000 |

Key Elements

- The trial balance includes all of the company’s accounts, including assets, liabilities, equity, revenue, and expenses.

- The balances of the accounts are listed in the right-hand column.

- The trial balance must balance, meaning that the total of the debit balances must equal the total of the credit balances.

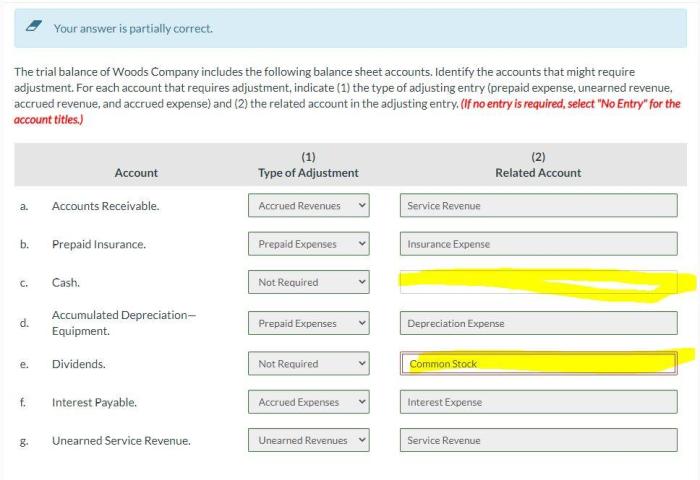

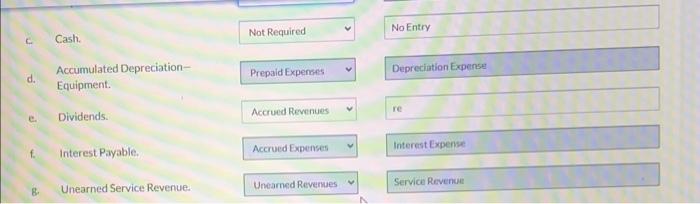

Analyzing Accounts and Balances: The Trial Balance Of Woods Company Includes The Following

Types of Accounts

The trial balance includes all of the company’s accounts, which can be classified into the following types:

- Assetsare resources that the company owns or controls.

- Liabilitiesare debts that the company owes.

- Equityis the owner’s investment in the company.

- Revenueis the income that the company generates from its operations.

- Expensesare the costs that the company incurs in its operations.

Analyzing Balances

The balances of the accounts can be used to analyze the company’s financial position. For example, the balance of the cash account can be used to determine how much cash the company has on hand.

The balance of the accounts receivable account can be used to determine how much money the company is owed by its customers.

The balance of the inventory account can be used to determine how much inventory the company has on hand.

Identifying Errors and Discrepancies

Importance of Reviewing a Trial Balance

It is important to review a trial balance for errors because errors can lead to inaccurate financial statements. Errors can occur for a variety of reasons, such as:

- Mathematical errors, such as adding or subtracting incorrectly.

- Posting errors, such as posting a transaction to the wrong account.

- Omission errors, such as failing to record a transaction.

Common Types of Errors

Some of the most common types of errors that can occur in a trial balance include:

- Debits that do not equal credits. This is the most common type of error and can be caused by a variety of factors, such as mathematical errors or posting errors.

- Accounts that are out of balance. This can be caused by omission errors or posting errors.

- Transactions that are recorded in the wrong period. This can be caused by errors in the recording process or by errors in the closing process.

Identifying and Correcting Errors

Errors can be identified by reviewing the trial balance and looking for any inconsistencies. Once an error has been identified, it should be corrected immediately.

Utilizing the Trial Balance for Financial Reporting

Role of the Trial Balance, The trial balance of woods company includes the following

The trial balance plays an important role in the preparation of financial statements. The trial balance is used to ensure that the debits equal the credits and that all of the accounts are included in the financial statements.

Ensuring Accuracy and Completeness

The trial balance helps to ensure the accuracy and completeness of the financial statements by providing a way to check for errors. If the trial balance does not balance, then there is an error in the accounting records that needs to be corrected.

Commonly Asked Questions

What is the purpose of a trial balance?

A trial balance is used to check the mathematical accuracy of a set of accounting entries by ensuring that the total debits equal the total credits.

What are the key elements of a trial balance?

The key elements of a trial balance include accounts, balances, and debit/credit amounts.

What types of accounts are typically found in a trial balance?

Typical account types found in a trial balance include assets, liabilities, equity, revenue, and expenses.

How can I identify errors in a trial balance?

Common errors in a trial balance can be identified by checking for unbalanced debits and credits, missing accounts, and incorrect account balances.